It is common for business owners to feel frustrated by insurance premiums consistently on the rise. As insurance brokers, we hear the frustrations daily. But in response, we ask, “Did insurance rates change, or has your business grown?”

The three operational factors that impact the price of insurance are:

- Gross sales

- Payroll

- Assets, including fleet, equipment, or buildings

As these operational investments increase, so will the cost of insurance. It is important for business owners to understand their cost of insurance in terms of gross sales so they can compare their insurance rates year over year.

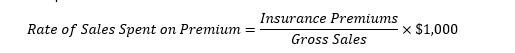

Here is a simple formula:

For example, a company with $15,000,000 in gross sales pays $600,000 in premiums annually. Based on these figures, $40 of every $1,000 in sales is used to pay for insurance premiums.

This same formula can be used to find the rate of other operational investments like:

- People

- Technology

- Vehicles or equipment

- Safety Investments

By accurately comparing year-over-year expenditures, you can ensure you are investing your money in areas that provide the highest rate of return. If on comparison you find your insurance costs are too high, the next step is to calculate your Indirect Costs of insurance and Safety Investments. Insurance premiums, indirect costs associated with losses, and safety investments combined make up your Total Cost of Insurance.

Takeaway

Take the time to calculate the rate you pay in insurance premiums per $1,000 of gross sales and compare it other operational investments.

Next Step: Calculate the hidden costs of your insurance program. Having control over the costs of your insurance starts with evaluating your losses.